CIF Incoterms: What CIF Incoterms Means, Pros and Cons

When it comes to international trade, understanding the right Incoterms can make a significant difference in how responsibilities and costs are shared between the buyer and seller. Oneclick Online Service specializes in simplifying these complex terms, including CIF, to help you navigate global shipping with ease. In this blog, we’ll explore what CIF Incoterms are, how they work, and compare them briefly to other Incoterms. Read on to discover how CIF can impact your trade agreements and shipping responsibilities.

What is CIF Incoterms?

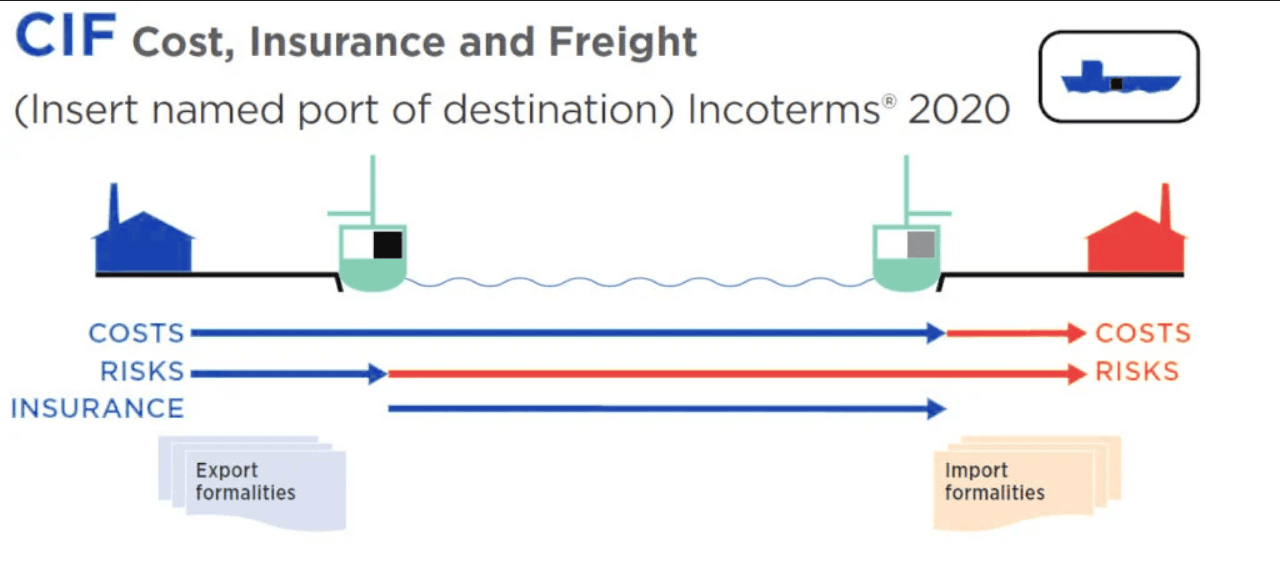

CIF stands for Cost, Insurance, and Freight, a widely used shipping Incoterm in international trade. CIF requires the seller to arrange and pay for the transport of goods to the destination port, as well as provide insurance to cover the goods while in transit.

In this arrangement:

- The seller is responsible for costs up until the goods reach the destination port, including insurance.

- The buyer assumes risk and responsibility for the goods once they arrive at the destination port and must handle import duties, customs clearance, and final delivery.

Shipping Incoterms like CIF are vital in defining the exact responsibilities between trading parties, ensuring smooth transactions and minimal disputes.

CIF Risk and Costs

Under the Cost, Insurance, and Freight (CIF) Incoterm, the seller assumes significant responsibilities, including arranging transport and providing insurance for the goods until they reach the destination port. However, the risk transfers from the seller to the buyer once the goods are loaded onto the shipping vessel at the port of departure. This distinction makes CIF an Incoterm that balances the responsibilities between the buyer and seller while ensuring insurance coverage for the goods during transit.

Seller is Responsible For:

1. Goods and Documentation:

- Ensuring the goods are appropriately packed and ready for export.

- Providing necessary documentation, including the commercial invoice, packing list, and bill of lading, which the buyer will need for customs clearance at the destination.

2. Transport to the Port of Departure:

- Arranging and paying for transportation of the goods to the port of departure.

- Bearing all associated costs, including loading the goods onto the vessel.

3. Freight Costs:

- Paying for the shipment of goods from the port of departure to the destination port.

- Selecting a reliable carrier to ensure timely delivery to the destination port.

4. Insurance:

- Providing minimum insurance coverage for the goods during transit to the destination port, as specified under the CIF terms.

- The insurance must cover the value of the goods plus 10% (110% of the invoice value) and protect against risks during transport.

Buyer is Responsible For:

1. Risk After Loading:

- Assuming responsibility for the goods as soon as they are loaded onto the vessel at the port of departure. While the seller provides insurance, any claims for loss or damage require the buyer to handle the insurance process.

2. Customs Clearance at the Destination:

- Managing all import-related processes, including customs duties, taxes, and clearance procedures, at the destination port.

- Providing any additional documentation required by customs authorities.

3. Unloading and Final Delivery:

- Arranging and paying for the unloading of goods from the vessel at the destination port.

- Handling transport from the destination port to the final delivery location.

Key Points to Note:

- The seller bears the cost and responsibility for the goods until they reach the destination port but transfers the risk to the buyer at the port of departure.

- The buyer must be prepared to manage risks during transit, despite the insurance provided by the seller, and take full responsibility for importation and final delivery. CIF is an advantageous term for buyers who prefer the seller to handle most of the shipping process but are ready to manage the risks and costs after the goods are on board the vessel. It’s ideal for businesses new to international trade or with limited logistics infrastructure.

When to Use CIF Incoterms?

Cost, Insurance, and Freight (CIF) is a popular Incoterm in international trade that strikes a balance between the responsibilities of the seller and the buyer. It is particularly suited for transactions involving sea or inland waterway transport. Below are the scenarios in which using CIF Incoterms is most appropriate:

1. When the Buyer Prefers the Seller to Handle Shipping and Insurance

CIF is ideal when the buyer wants the seller to manage the logistics of transporting goods to the destination port. This includes:

- Arranging and paying for freight.

- Securing insurance coverage for the goods during transit. This reduces the buyer’s logistical burden, as the seller handles the shipping arrangements and ensures the goods are protected during the journey.

2. When the Buyer Wants Limited Risk During Transit

Under CIF, the seller provides insurance coverage for the goods while they are in transit. This is advantageous for buyers who:

- Want financial protection against loss or damage to the goods during shipment.

- Prefer to avoid arranging insurance themselves. It’s important to note, however, that the seller’s insurance typically provides minimum coverage, so buyers may want to arrange additional insurance if higher protection is needed.

3. For First-Time Importers or Buyers New to International Trade

CIF is well-suited for buyers who are inexperienced with managing shipping logistics. With the seller handling the key responsibilities up to the destination port, first-time buyers can focus on learning the customs and import processes at the destination.

4. When the Goods Are Being Shipped by Sea or Inland Waterway

CIF is specifically designed for transactions involving maritime transport. It’s not suitable for air or land transport, so it’s best used when:

- Goods are being shipped across oceans or rivers.

- Sea freight is the most economical and practical mode of transport for the shipment.

5. When the Destination Port Has Established Infrastructure

CIF is most effective when the destination port has efficient infrastructure for unloading and transferring goods to the buyer. This ensures smooth operations after the goods arrive at the port, making it easier for the buyer to take over responsibilities.

6. When Buyers Want Predictable Shipping Costs

CIF provides cost predictability for buyers, as the seller includes freight and insurance in the overall price. Buyers benefit from knowing the total cost of delivery to the destination port, which helps with budgeting and financial planning.

Key Considerations When Using CIF

- Risk Transfer: While the seller manages transport and insurance, the risk transfers to the buyer as soon as the goods are loaded onto the shipping vessel at the port of origin. Buyers must be prepared to handle claims if there is damage during transit.

- Insurance Coverage: The seller’s insurance under CIF typically offers minimum coverage. Buyers should evaluate if this is sufficient or if additional coverage is necessary.

CIF is an excellent choice for buyers who prefer a simpler shipping process, want limited logistical responsibilities, and require basic insurance coverage. It’s particularly beneficial for sea freight transactions where the seller’s expertise in arranging transport and insurance can save the buyer time and effort.

Comparing CIF Against Other Incoterms

When choosing the right Incoterm for international trade, understanding the differences between CIF (Cost, Insurance, and Freight) and other terms like EXW (Ex Works) and FOB (Free on Board) is essential. Each term defines the responsibilities and risks borne by the buyer and seller, offering distinct advantages depending on the trade scenario.

CIF vs EXW

CIF and EXW represent two extremes in terms of responsibility. Under CIF, the seller is responsible for transporting the goods to the port of origin, loading them onto the vessel, paying for freight to the destination port, and providing minimum insurance during transit. The buyer takes responsibility only after the goods are loaded onto the vessel, handling import customs clearance, duties, taxes, unloading, and final delivery. In contrast, EXW places the minimum obligation on the seller, who is only required to make the goods available at their premises or another agreed-upon location. The buyer assumes responsibility for all logistics, including transportation, export formalities, customs clearance, insurance, and delivery. CIF is best suited for buyers who prefer the seller to handle shipping and insurance up to the destination port, reducing their logistical burden. On the other hand, EXW is ideal for buyers with strong logistics capabilities who want full control over the transportation process and costs.

CIF vs FOB

The comparison between CIF and FOB lies in the extent of the seller’s responsibility. Under CIF, the seller handles transportation to the port of origin, loading onto the vessel, freight to the destination port, and provides insurance during transit. The buyer takes responsibility after the goods are loaded onto the vessel, managing unloading, customs clearance, duties, taxes, and final delivery. FOB, however, places less responsibility on the seller. They are responsible only for transporting the goods to the port of origin and loading them onto the vessel. The buyer assumes responsibility from this point forward, arranging freight, insurance, and all subsequent transportation and clearance processes. CIF is ideal for buyers who want the seller to manage most of the shipping logistics and provide basic insurance, offering convenience and reduced effort. FOB, on the other hand, works well for buyers who prefer to take control of freight and insurance arrangements after the goods are loaded onto the vessel, potentially allowing for cost savings and customization.

FAQs for CIF Incoterm

1. What does CIF stand for in shipping?

CIF stands for Cost, Insurance, and Freight. It defines the seller's responsibility to deliver goods on board the vessel at the port of shipment, covering the cost of transport and providing minimum insurance for the goods while in transit. In other words, CIF meaning outlines the division of duties between the seller and buyer, specifying that the seller is responsible for the cost, insurance, and freight until the goods reach the destination port.

2. What does CIF Incoterm cover, and who is responsible for insurance?

CIF (Cost, Insurance, and Freight) requires the seller to handle transportation of goods to the destination port and provide minimum insurance coverage for the goods during transit. The insurance must cover 110% of the invoice value, protecting against potential damage or loss. However, the risk of loss or damage transfers to the buyer once the goods are loaded onto the shipping vessel at the port of origin. Buyers may choose to purchase additional insurance for extra protection.

3. When should I use CIF instead of other Incoterms?

CIF is ideal for transactions involving sea or inland waterway transport where the buyer prefers the seller to manage shipping and insurance to the destination port. It is particularly beneficial for buyers who are less experienced in handling logistics or who want to reduce their responsibilities in the shipping process. However, buyers should be prepared to handle customs clearance, unloading, and final delivery once the goods arrive at the destination port.

At Oneclick Online Service, we understand how vital it is to work with dependable suppliers. We make it easier for you by offering seamless product sourcing from China. With our expertise, you can build a strong foundation for your dropshipping or Wholesale business and maintain a steady flow of quality products.

For assistance with sourcing and managing your dropshipping needs, feel free to contact us, or register for our app to begin your journey with Oneclick. We're here to help every step of the way.